Accounts

Description

Account endpoints can be used to register a new user with Send Payments. There are 2 different Customer Account types: Corporate and Individual. Each Customer Account has custody of a Trading Account (the ID of which is supplied in the response after creating an Account) which are the backbone of the Send ecosystem.

In terms of data objects, Customer Account ID contains the data about the Account itself (i.e. the entity details) while the Trading Account ID is what all the financial data is linked to.

In general the Account creation can follow two paths:

- Trusted Path

- KYC Path

The path an Account is routed down is defined at the start of a partnership between Send and the Client. To find out which path is set up for your Account you can contact your project lead.

Trusted Path

Trusted path means Send have validated your AML/CTF/KYC policies and is confident they match or exceed those conducted by Send. In these cases created accounts skip any checks made during the KYC Check and go straight to registered.

KYC Path

KYC Path means that Send will take responsibility for all the KYC procedures within the account creation process.

With the KYC path, nearly all of the optional fields in the POST request for an account become mandatory.

Currently, if within the KYC path and Send is unable to verify the customers details or requires proof of identity (ie a photo of the drivers licence or passport) we will reach out via established support channels to fetch this identity document. On our product roadmap is the goal to introduce a dynamic link which can be supplied to customers in order to fetch these details.

How to create an Account

This section explains how to create both Individual and Corporate Accounts, specifies the details you need to provide and the data Send will supply in response.

A note of required fields

Send will work with you during the implementation/integration phase to determine which fields are required when adding a new customer. This will be dependent on your proposed use case, risk levels and customer types.

Individual Account

To create an Individual Account you need to send a POST /accounts/individualrequest including the accessToken you’ve received during the Authentication process in the headers.

Within the request you should specify your customers personal data, contact information, address and ID documents data.

When adding the Physical Address please refer to the following guidelines.

A note on Australian Drivers Licences.

identityCardNumberis used specifically for the cases when a drivers licence is used and as the drivers licenceidentityNumberand theidentityCardNumberare 2 separate fields on the ID doc.If you require more information please see here: Finding your Transport and Main Roads reference numbers

Corporate Account

To create a Corporate Account you need to send a POST /accounts/corporate request including the accessToken you’ve received during the Authenticationprocess in the headers.

Within the request you should specify your business data, contact information, address and Authorised Representatives data. In the event the corporate account is a trust, please include all trustees represented on the trust deed as Authorised Representatives.

When adding the Physical Address please refer to the following guidelines.

In response to your request you will receive either a SUCCESS 201 response or one of the error responses (400, 401, 500) See Status Codes & Error Messages.

In case of successful response you will receive back all the information you’ve sent with a couple additional but very important data fields. You will be assigned with the accountId and tradingAccountId which will be later used to link all the operations to your Account. So in order to interact with the application you will need to store them both.

Using the IDs

The

accountIdis used to fetch the Account object and is correlated with the identity of the account owner.

ThetradingAccountIdis the main ID used when making financial transactions on the platform. e.g. in Payments.

In addition to IDs the response will contain the status of your Account, createdAt and updatedAt dates and time.

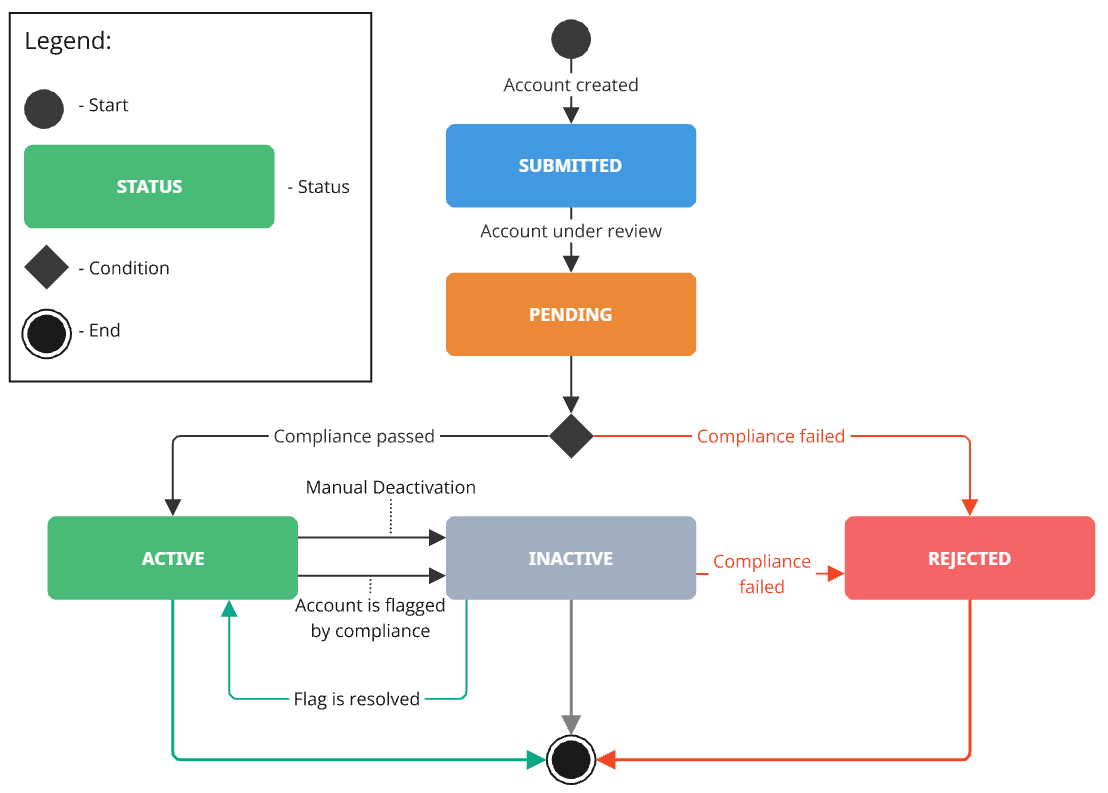

In the initial response you should receive the Submitted status.

If the procedure follows the Trusted path then the status of the Account will be changed to directly to Active after the system will be done with Account creation.

If the procedure follows the KYC path then the status of the Account will be changed to Pending

and basing on the result of the KYC check the status can be then changed to "Active" in case of successful check

and Rejected in case of failed check.

| Status | Description |

|---|---|

| Submitted | Account data is validated and has the Id assigned |

| Pending | Account is going through KYC or is waiting for further information |

| Active | The Account has passed the KYC check. |

| Rejected | The Account has failed the KYC check |

| Inactive | The Account has been manually deactivated or has been flagged due to ongoing monitoring |

To receive updates on the account status changes please refer to Webhooks page.

Changing of the status for the Account can be tracked using Webhooks.

Authorised Representatives

An Authorised Representative is a person who will be able to act on behalf of the Corporate Account

to make changes or book financial transactions on the Send Account.

For the Corporate Account at least one Authorised Representative must be added within the POST /accounts/corporate request. Additionally, you should provide all the company directors, majority shareholders or trustees as additional Authorised Representatives.

Adding new authorised representatives to the account will cause the account to undergo a re-review.

Authorised Representatives data is sent within an array.

So you are able to add as many as needed within a single request.

Specifying the Physical Address

When adding the physical address we allow you to populate the fields in 1 of two ways:

- Utilise

addressLine1,country,city,stateandpostcodeto fill in the address. - Split the address into each of the available sub-components (ie

streetName,streetNumberetc). Splitting these fields will help expedite the KYC process, but is not mandatory.

How to add Authorised Representatives for the already existing account

If you missed adding Authorised Representatives while creating an Account or just need to add more you can send a signed POST /accounts/{accountId}/authorised-representatives request with the Authorised Representative data only.

In response to your request you will receive either a SUCCESS 201 response or one of the error responses (400, 401, 500) See Status Codes & Error Messages.

While the Authorised Representative is under the Compliance Check the status of the account will be put to Pending which will change after the Check is accomplished. Depending on the Check result it will be Active if the check was passed successfully and Rejected if the check was failed.

Changing of the status for the Account can be tracked using Webhooks.

Fetching Account Information

To request the information about the Account you can send a signed GET /accounts/{accountId} request.

In response to your request you will receive either a SUCCESS 200 response or one or the error responses (400, 401, 500) See Status Codes & Error Messages.

Given a valid accountId in the URL, a SUCCESS 200 response will return the details for an individual or corporate account, including authorised representatives, as per the SUCCESS 201 responses for the POST /accounts/individual and POST /accounts/corporate respectively.

Not Seeing What You're Looking For?

We are always looking to improve our API documentation to ensure Sends systems are easy to understand and quick to build against. If you're struggling to find the answer to a question we either haven't made it easy enough to find the relevant docs or we haven't had a chance to write something up for it yet.

Either way we want to hear from you!

Head over to our Discussion Board and leave us a note. We keep a close eye on this and want to ensure we make these docs as useful as they can be so will jump on any posts quickly.

Updated 3 months ago